What Will Happen Next Year?

“What do you think the market is going to do in the next x months/years?”

It’s the most common question we get asked.

And we can’t answer it.

As REALTORS®, we shouldn’t predict the real estate market. We’re not economists and so it’s not our role, so the Real Estate Act doesn’t allow it.

What is our role? Well, we deliver unbiased statistics and interpret them, honestly inform buyers and sellers the value of the properties they are considering buying or selling, and we offer our representation & marketing services. Then, if they wish, we execute the transaction.

But what can we say when someone asks us about the future of the real estate market?

There are a few things, but today I’ll just cover one of them.

Hopefully you will finish reading this blog feeling a little more informed, and satisfied.

Confessions of a Failed Economist

I have a Masters in Economics for Development from the University of Oxford, but I really didn’t understand economics until the last few years.

I was taught that economics is the study of decision-making; that it’s rooted in human psychology, and that firms & households make decisions based on prices (e.g., wages & rents), which determine aggregate supply & demand for products and services in the marketplace.

Like a lot of people at school, I learned plenty in class, but I didn’t really know what that all meant.

What’s worse, not knowing that I would become a REALTOR®, I didn’t choose Real Estate Economics modules at either college (isn’t hindsight 20/20?).

Finding Answers

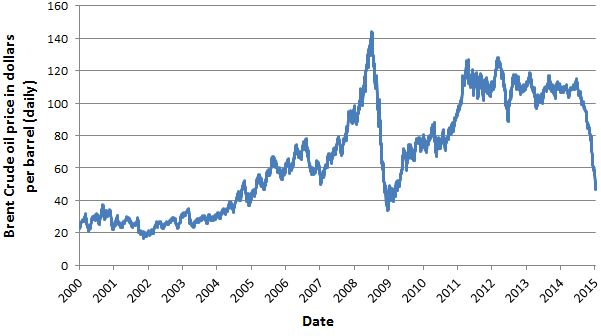

It was about 3 years ago, in November 2014, that I first googled “how oil prices affect real estate prices”. OPEC had just made their decision to respond to the US shale boom by opening up the spigots.

Oil prices were heading south. And fast.

The 2014 oil price crash did a number on the housing market in Fort McMurray. (Credit:Kunstler)

The 2014 oil price crash did a number on the housing market in Fort McMurray. (Credit:Kunstler)

I wanted to get a sense of what we were in for.

I happened upon the 2005 master’s thesis of a Massachusetts Institute of Technology (MIT) student named Mercedes Padilla entitled:

“The Effects of Oil Prices and Other Economic Indicators on House Prices in Calgary, Canada.” (MIT Library link)

Now, that paper wasn’t published in a journal, and as a result, was not peer-reviewed, but the work of the supervising professor is peer-reviewed, and enthusiastic readers can read through Professor Wheaton’s list of highly relevant published work here.

What Was The Point of The Study?

The study attempted to figure out what determines house prices in markets that are dominated by oil. Namely:

-What are the main factors?

-Which factors are the most important?

-How long does it typically take for changes in the resource price, or other determinants, to impact the real estate market?

This was perfect.

This could really help our messaging. If we had a sense of the answers to these questions next time our clients ask us about prices (typically potential seller clients), then we could refer them to this paper so they could draw their own conclusions.

And The Results?

The results of the study need to be taken with a big grain of salt for at least five reasons

, but here are the main results:

- A small list of 4 factors explained 98% of the variation in single-family home prices over time.

- Those factors were i) employment, ii) the exchange rate, iii) the real interest rate, iv) the oil price.

- Oil prices impact prices directly (through a wealth effect) as well as indirectly through employment.

- A cheap loonie impacts prices directly (through foreign buyers) and indirectly through employment because oil companies become more profitable ceteris paribus.

- Low interest rates impact house prices directly (cheaper payments) and indirectly through employment because businesses become more profitable ceteris paribus.

- All other factors being equal for every $2-a-barrel change in oil prices housing prices were affected by 1%.

Regarding lags: i) it was the immediate level of employment that impacted home prices ii) the exchange rate impacted home prices 1 year later, iii) interest rate changes impacted home prices over the following two years, iv) the full effect of oil price changes wasn’t felt until 1 year and 9 months after the oil price change.

Is it Worth Taking Seriously?

Well, that’s entirely up to you!

What I will say, is that in hindsight, in Fort McMurray, we have seen oil prices change by about $50 and three years later, benchmark home prices for single-family homes have changed by about 20-25%. The interest rate, exchange rate, and employment have also changed, which complicated things (so, of course, does the wildfire), but generally speaking, we have seen the predictions of the academic paper play out.

What Have I Learned?

Old-school economics teaches us that families, when given “perfect” information, will make correct decisions that maximize their happiness. Of course, that’s an idealistic view of the world because making good decisions is really hard (

see last week’s blog about reference points).

The business of real estate is done at the kitchen table, and it can be an intense place when decisions are made. Watching those decisions almost as a fly-on-the-wall has been a bit difficult, but I’ve learned a few things:

- People really do systematically make better decisions if presented with good quality information that they can trust. Our job is to provide that information.

- There are important ratios (for example, the absorption rate), which determine the current state of the market. These can help guide potential buyers and sellers when fine-tuning the timing of their moves.

- It’s not possible to predict the future.

- Oil prices and credit availability are enormous exogenous forces which clearly determine the price of Fort McMurray real estate.

- By extension, people interested in the value of Fort McMurray real estate do well to stay informed about the oil market and federal government/central bank policies (follow us on Twitter for relevant articles).

- The value of your primary residence is going to vary greatly over time, and that’s normal in a resource town. Generally, people time the purchases and sales of these homes with the needs of their lifestyles, and that’s a good thing. However, especially those people with shorter timelines, and with higher risk-aversity, do well to arm themselves with quality information prior to making any big decisions.

The Future of Fort McMurray Real Estate

(We don’t predict the future, but here are some things to watch for in 2018...)

The rebuild looks sure to continue: Congrats to everyone moving back home! :)

The oil glut may or may not disappear during 2018:

How Saudi Arabia plans to end the oil glut

The world’s top oil exporter Saudi Arabia is determined to reduce inventories further through an OPEC-led deal to cut crude output and raised the prospect of prolonged restraint once the pact ends to prevent a build up in excess supplies.

Saudi Energy Minister Khalid al-Falih, speaking during an investment conference in Riyadh, said on Tuesday the focus remained on reducing the level of oil stocks in OECD industrialized countries to their five-year average.

The Organization of the Petroleum Exporting Countries, plus Russia and nine other producers, have cut oil output by about 1.8 million barrels per day (bpd) since January. The pact runs to March 2018, but they are considering extending it. Via business.financialpost.com

Speaking of the oil market, here are some possibly relevant reading topics:

-US shale

-Provincial election (2019)

-The electric vehicle (EV) revolution

-Completion of Keystone XL

-Other pipelines

In relation to credit, we will be closely watching interest rates and their impact, as well as the impact of the new mortgage rules which come into effect January 1st, 2018.

In addition, we will be observing fly-in-fly-out as well as automation, Bill 21 and local issues. Some of these might be influenceable by the new Mayor and Council (or not).

It is well known that many changes to the credit, oil, and housing markets are often cyclical, but there might be longer-term elements, too. When confidence returns to our local housing market (all markets balance!), there may be a bump in demand. But are you expecting a rapid “v-shaped” recovery or more of a “new normal” Fort McMurray house price?

If you want to know what signs of recovery might look like, click here for an in-depth look.

UPDATE: Since this article was published, I've also taken a detailed look at how the real estate market in Fort McMurray is shaping up to be in 2018.

If you find this post useful, please feel free to share it with your friends. Comments are welcome in the space below. Thank you for reading!